How to Write a Business Plan

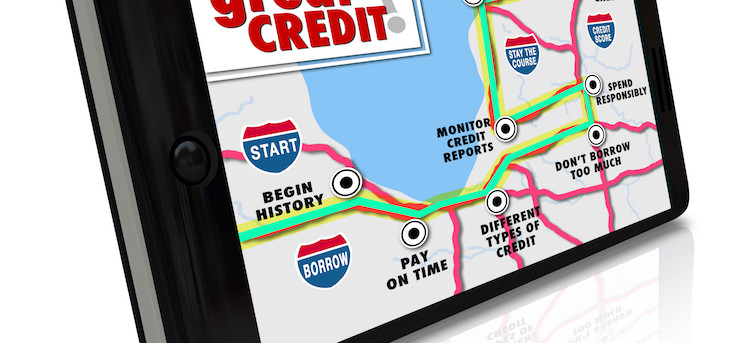

Starting a small business is hard work. The list of things you have to do in order to turn your dream into reality may seem overwhelming at first. Anyone who has searched "how to start a small business" online has seen page after page populate with articles on loans, investors, incorporating, credit scores, cash flow, taxes, permits—the list goes on and on. When faced with such a formidable to-do list, it is easy to think of a formal business plan… Read More