Starting with the 2024 tax year, more business owners and individuals may receive copies of IRS Form 1099-K reporting transactions to the IRS. This isn’t a new form, but in the future more of them will be issued, and may create a lot of confusion and headaches at tax time.

Here’s what you need to know about the 1099-K tax form and your small business.

What Is the IRS 1099-K Form?

Freelancers, independent contractors and business owners are often familiar with 1099 forms in general. When you earn more than $600 in a year for services as a freelancer or contractor, the company that paid you is supposed to file a 1099 form with the IRS, and send you a copy. The two most common forms used for these kinds of payments are:

- 1099-MISC (miscellaneous income including prizes and awards)

- 1099-NEC (nonemployment compensation)

It’s also possible, but less likely, that you will receive a copy of a 1099-K. If you haven’t received one in the past, that may change for tax years 2024.

Form 1099-K, Payment Card and Third-Party Network Transactions, is designed to capture certain payment transactions that may not get reported to the IRS. The goal is to “increase voluntary compliance with tax requirements,” which also happens to make it harder for individuals or businesses to avoid paying taxes on certain types of transactions.

This form reports credit or debit card transactions received by a business. It also reports certain payments from payment networks like PayPal, Zelle, Cash App or Venmo.

The American Rescue Plan dropped the threshold to $600 in payments in a year, with no limit on the number of transactions. That means one transaction for more than $600 is supposed to trigger this form.

However, due to extensive feedback from taxpayers, tax professionals, and payment processors and to reduce taxpayer confusion, the IRS is delaying implementation of the forms at the $600 threshold. See more in the 2023/2024 update below.

If you are due a 1099-K, you should receive it by January 31st for the previous year’s transactions. (January 31, 2024 would be the deadline for 2023 transactions, for example.)

Third-party settlement organizations who must file 1099-K statements with the IRS must meet these deadlines:

- Paper 1099-K statements must be filed with the IRS by Feb. 28 of the year following the transactions.

- Electronic Forms 1099-K must be filed by March 31 of the year following the transactions.

It’s also worth noting that several states—Maryland, Massachusetts, Mississippi, Vermont and Virginia, and the District of Columbia—already use the lower $600 limit. Arkansas has a threshold of $2500 while Illinois and New Jersey both have a $1000 threshold (IL also requires 4 or more transactions.)

IRS Announces Delay in Form 1099-K Reporting Threshold

1099-Ks shouldn’t be a big deal for business owners who keep up with their bookkeeping. After all, they are used to reporting all income their business receives–or should be.

But many people who have not been receiving 1099 forms in the past may receive them as a result of this change, and that could also trigger lots of questions to the companies that issue them, tax preparation firms, and accounting software providers.

As a result there have been several delays.

IRS Announces 2023 Form 1099-K Reporting Threshold

First, the IRS has announced a transition period. For calendar year 2023, 1099-K forms are not required unless:

- Gross receipts (total) amount of aggregate payments to be reported exceeds $20,000 and

- There are more than 200 transactions with that payee.

This is the previous threshold that was in place and should not affect casual online sellers or most users of payment apps.

2024’s 1099-K rules

In addition to making 2023 a transition year for 1099-K forms, the IRS has announced that it is planning a threshold of $5000 for 2024 to continue the phase-in for these forms. It’s possible that could change depending on how it goes for the tax year 2023, but the current plan is to gradually work down to the $600 threshold.

Types of Transactions Reported on 1099-K

Form 1099-K reports the gross amount of all payment transactions, whether those are for your business, transactions as someone who is self-employed, or even transactions when you sell personal items on marketplaces that are required to file 1099-Ks.

- Payment card transaction means any transaction in which a payment card, or any account number or other identifying data associated with a payment card, is accepted as payment.

- Third party network transaction means any transaction that is settled through a third-party payment network, but only after the total amount of such transactions exceeds the minimum reporting thresholds. A third party network transaction may include a payment through a payment app.

Let’s say you own a lawn care business and your customer pays you through Venmo. If your total transactions for the year totaled $600 or more, regardless of the number of transactions, Venmo will be required to file a 1099-K with the IRS reporting your transactions.

What some people might consider personal transactions can fall into reportable territory. For example, if you sell personal items on eBay or another marketplace the IRS considers those reportable transactions, even if you didn’t make money. You can then report it on your taxes as a loss.

It’s also worth noting that your purchases do not trigger a 1099-K; payments do. In other words, simply using a business credit card to pay for business expenses doesn’t mean you’ll get (or have to file) a 1099-K form. But if your business accepts credit or debit cards and your customers use them to make purchases from you, that will trigger a 1099-K from your payment processor or merchant bank. (The IRS refers to these organizations as payment settlement entities or PSEs. They help your business accept credit and debit card payments directly.)

How To Manage 1099-K Transactions

If you are using accounting software and have a good bookkeeping process in place, and you report all your income, this should have a good bookkeeping process in place and keep track of all your business income and expenses.

If you use sites like ebay, Venmo, Zelle, CashApp or PayPal, whether personally or professionally, make sure you properly categorize your transactions, and that people who send you money do the same.

Otherwise you could receive a 1099-K that includes transactions that don’t qualify, such as getting reimbursed after splitting a restaurant bill with a friend.

Cash App’s states states: “Form 1099-K is used to report transactions for the sale of goods and/or services made to Cash for Business accounts. If you have a personal Cash App account, you will not receive a Form 1099-K from Cash App, and Cash App will not report any of your personal transactions to the IRS.”

Venmo states: “This requirement (1099-K) only pertains to payments received for sales of goods and services and DOES NOT apply to friends and family payments. When sending money on Venmo, users can choose to tag a payment as being for “goods and services”. Whether it’s for a product you sell, a service you provide, or even an old couch you don’t want anymore, the person paying for the item or service can decide whether to tag the payment. All payments sent to business profiles on Venmo are tagged as purchases automatically and are therefore considered to be for goods and services.”

PayPal states: “This new Threshold Change (for 1099-K reporting) is only for payments received for goods and services transactions, so this doesn’t include things like paying your family or friends back using PayPal for dinner, gifts, shared trips, etc. PayPal tax reporting is required when the sender identifies the product as goods and services to the IRS, even if it was a mistake. This requirement applies once you receive $600 USD or more from this type of payment. Both PayPal and Venmo offer a way for customers to tag their peer-to-peer (P2P) transactions as either personal/friends and family or goods and services by choosing the appropriate category for each transaction.”

eBay states: “If you haven’t already given us your 9-digit Social Security number (SSN) or Individual Tax Identification Number (ITIN), we’ll ask you to provide it once you reach $600 in sales. If you don’t provide your 9-digit TIN, your payouts will be put on hold and we may deduct backup withholding from future payouts.”

Etsy states: Along with other information, Etsy states, “If you run multiple shops, the sales across all your shops will be combined based on your SSN/EIN number. If the sales across your shops total more than either the federal threshold or a state threshold, you’ll receive a single 1099-K form for your combined gross income from all your shops.”

For everything you sell online, it’s recommended you keep a record of each transaction, including the original cost of the item and any selling related expenses. Keeping track of your expenses will help you determine the cost basis of each item you sell and will come in handy when you do your taxes.

1099-K Best Practices

In summary, there are three best practices for small business owners and individuals when it comes to using these apps:

- Use a business version of the app for business transactions and the personal version for personal transactions. This same advice applies to freelancers or business owners when it comes to using a business bank account versus a personal account, or a business credit card versus a personal credit card. Keep business and personal separate.

- Be sure to properly categorize personal transactions, and keep records of anything you sell personally on these apps. If you’re cleaning out your closet or garage and selling items online, for example, you’ll want to keep records of what you’ve paid for those items you sold so you can either identify how much you made (and pay taxes accordingly) or how much of a loss you took. (You can’t deduct losses on the sale of personal items, unfortunately, but at least you won’t owe taxes.)

- Provide your business tax identification number (usually an Employer Identification Number or EIN) for your business account to avoid backup withholding, and to make sure business transactions aren’t reported as personal transactions. If you don’t already have one, here’s how to get an EIN for free. It’s quick and easy to do so. Consider forming a business entity like an LLC or corporation to clearly separate your business and personal finances.

Note that the gross payments reported won’t include fees, adjustments. You’ll need to keep your own detailed records of fees, sales taxes, refunds and other amounts that can lower the gross amount to ensure you don’t pay more taxes than necessary. Again your bookkeeping software, or a professional bookkeeper, can be a huge help here.

How Form 1099-K Relates To Small Businesses

If you accept credit or debit card payments in your business, nothing will change there. If you’ve been using apps like CashApp or Venmo to accept payments for your business, you may get a 1099-K when you didn’t in the past. If you already report your business income, regardless of whether you receive a copy of this form, then not much should change. You’ll just have to review each form carefully to make sure it is accurate.

One hiccup you may run into is personal transactions that are mingled with personal transactions reported on 1099-K. If you’re running all your transactions through your personal Social Security number, then personal and business transactions will be reported together.

This is another incentive to form a business entity and use the business account version of these platforms so you don’t mix business and personal transactions at tax time.

How To Review a 1099-K Form

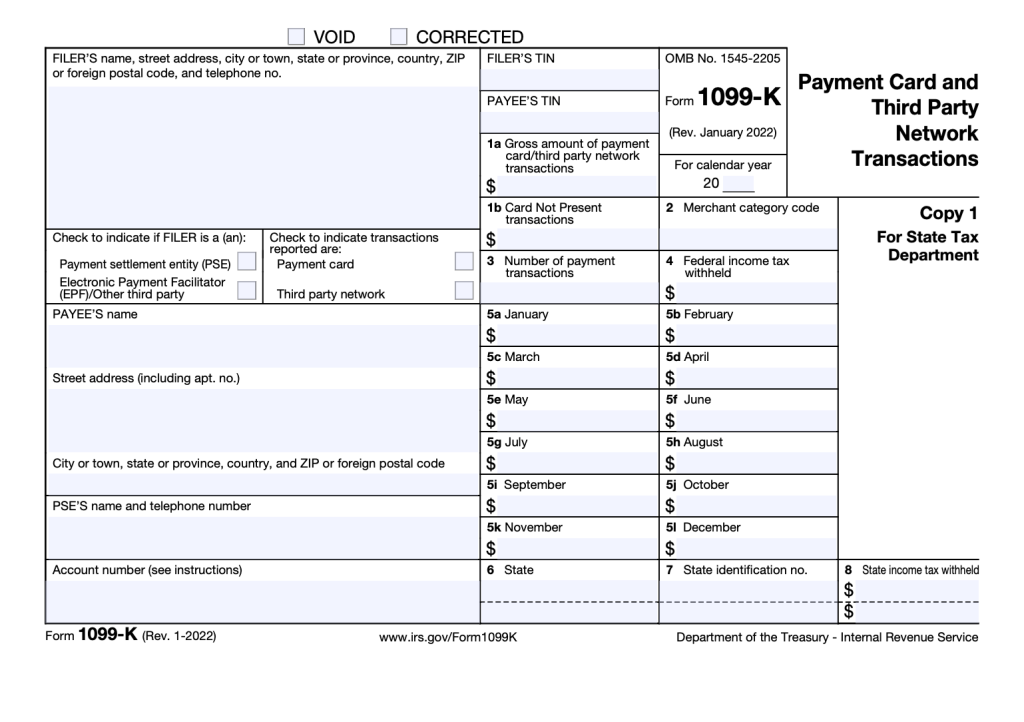

Here’s what a 1099-K Form looks like. It is an informational return, which means it just reports information. The company that files the 1099-K must send this form to the IRS, and a copy to the recipient.

A few things to look for on the 1099-L:

Make sure the Payee’s name (that’s you – the individual or business who receives the form) is correct and that you have provided an up-to-date address so you receive a mailed copy. You should also be able to access a copy online through your payment app account if you can’t find the mailed copy.

Check the Payee’s TIN – this refers to the taxpayer identification number, either your Social Security number or an employer identification number you’ve provided. Make sure it’s correct.

Check the amounts reported and make sure they are correct. Again, if you’ve been keeping up with your bookkeeping it should be fairly easy to reconcile this against your own records of sales. Just remember, this form reports gross sales, not sales minus fees or credits.

Where to Report Form 1099-K Income on Your Taxes

You won’t find a specific place on your income tax returns for reporting 1099-K transactions. Instead, you include them in your income, depending on the type of income.

When you get a Form 1099-K, you report that income to the IRS. Where you report it depends on how your business is structured.

- Freelancer, gig worker, freelancer, hobby seller and otherwise self-employed: As a sole proprietor without a business entity you will report your 1099-K and other income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship).

- Partnership: If your business is structured as a partnership, you’ll use Schedule E, (Form 1040), Supplemental Income and Loss.

- Corporation: Businesses that have incorporated will use Form 1120, U.S. Corporation Income Tax Return or Form 1120-S, U.S. Income Tax Return for an S Corporation.

If you have transactions that do not relate to your business for which you receive a 1099-K you’ll need to include those with your personal return, which usually means Form 1040.

Do I Need to File a Form 1099-K for My Hobby?

You don’t file 1099-K forms; payment providers do. And they file them with the IRS, so once they have filed it, that income is on record with the Internal Revenue Service and affects your taxable income.

The IRS expects you to pay taxes on income-generating activities, even if you have a hobby and not a business. (Unlike businesses, hobbies aren’t subject to self-employment taxes, also called payroll taxes, for Medicare and Social Security.)

The IRS offers a helpful guide that can help you understand whether you have a hobby or business, and the tax implications of each.

Common Issues With 1099-K Forms and How To Address Them

The biggest issue with these forms is likely the confusion they will cause for individuals and business owners who didn’t receive them in the past, and who have not kept up with their bookkeeping.

If you receive a 1099-K that is not correct, you can contact the company that filed it and ask them to correct it. (An example would be if it included transactions that were not business transactions on a 1099-K for your business account, or it included personal transactions like getting reimbursed after splitting a meal with a friend).

Business owners have (hopefully) kept good records of business income and expenses, and in those cases, these forms shouldn’t cause a lot of problems.

But if you have not separated your business and personal transactions on these apps, or if you have mischaracterized these transactions, you could run into problems at tax time.

Your tax professional can help with issues you run into, and the IRS has published a set of FAQs about 1099-K transactions where you may find answers to your questions.

Will an Incorrect 1099-K Form Cause an Audit From the IRS?

When the IRS receives a 1099 form from a business, it matches it to the taxpayer’s return. Taxpayers are expected to pay taxes on income from a 1099 unless they can demonstrate why that amount should be excluded from income.

While an incorrect 1099-K may not trigger an audit from the IRS, it could result in a bigger tax bill. And if you’ve underpaid your taxes, the IRS will let you know.

If you get a 1099-K with the wrong amount, the IRS instructs you to ask the company that sent it to correct it. If you are unsuccessful you can report it on Form 1040, Schedule 1, Additional Income and Adjustments to Income, Part I, Additional Income, Line 8z, Other Income, with an offsetting entry in Part II, Adjustments to Income, Line 24z, Other Adjustments.

Nav’s Verdict: Form 1099-K

Freelancers, independent contractors and business owners who manage their business well by separating business and personal transactions, and staying up to date on their bookkeeping with accounting software should have nothing to fear from these forms.

But for those who have been running a business on the side and hoping the IRS doesn’t find out, these new 1099-K reporting requirements should be a wake-up call to set up those processes so they don’t wind up with a big tax bill and potentially expensive penalties from the IRS or their state taxing authority. And failing to pay business taxes can result in a tax lien which could hurt your business credit scores.

Read: 15 Step Checklist to Make Your Business Legit

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.