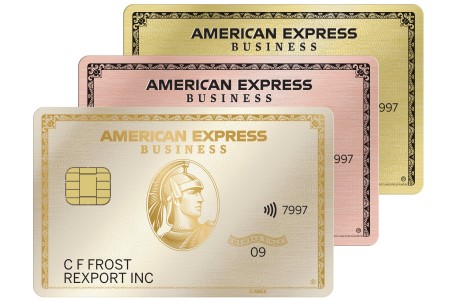

American Express® Business Gold Card

With the , you can customize your rewards program and earn on your top spending categories. This card carries a host of other benefits as well, including points back, Airline Bonus and the American Express Pay Over Time feature (on eligible purchases). Though this card is popular among business owners… Continue

Rates and Fees

| Intro APR | 0% on purchases for 6 months from date of account opening |

|---|---|

| Purchase APR | 18.49% - 27.49% Variable |

| Annual Fee | $375 |

| Welcome Offer | Welcome Offer: Earn 100,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.* |

| Rewards Rate | Earn 4X Membership Rewards® points on the top two eligible categories where your business spends the most each month from 6 eligible categories. |

Details

- Welcome Offer: Earn 100,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- 0% Intro APR ¤ for 6 months from the date of account opening on purchases eligible for Pay Over Time, then a 18.49% to 27.49% variable APR.*

- Earn 4X Membership Rewards® points on the top two eligible categories where your business spends the most each month from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.*

- Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.*

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.*

- Get up to a $12.95** statement credit back each month after you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. **Up to $12.95 plus applicable taxes on one membership fee.*

- The Business Gold Card comes in three metal designs: Gold, Rose Gold and White Gold. Make your selection when you apply on Americanexpress.com.

- *Terms Apply

Nav's Verdict

Bottom Line High annual fee, best for large purchases in consistent categories.

With the , you can customize your rewards program and earn on your top spending categories. This card carries a host of other benefits as well, including points back, Airline Bonus and the American Express Pay Over Time feature (on eligible purchases).

Though this card is popular among business owners with fluctuating spending needs, if you spend a significant amount of money on travel may want to consider the or the American Express Delta Business cards.

Conversely, if you’re seeking a straight forward rewards card for everyday use, you may want to look into the card or the card.

Features & Rewards

Card Review Details

As a rewards card, the offers a level of customization that sets it apart from some of the best business credit cards. While many business rewards cards allow business owners to select the category of their choice, the card adapts to your monthly spending habits.

For instance, if you spend the most on advertising and shipping in one month, the will retroactively reward 4X points on those purchases. If you spend more at gas stations and restaurants in the following months, then your top earning categories will update and you’ll receive 4X points for those purchases

The also offers other non-point related perks, including the Pay Over Time feature (on eligible purchases), which allows you to carry over balances above $100, and a 25% Airline bonus, which will earn you 25% points back when book air travel with AmexTravel.com.

While there certainly are perks associated with this card, it should be noted that there is a annual fee. If you are planning to use this card as your primary payment source, then you’ll likely find the fee, but if not, it may not be worth it. American Express offers numerous business credit cards, and so if you’re considering applying for a card, it may be helpful to compare all American Express business credit cards. As you review all cards, be sure to consider your spending habits, financing needs (e.g, balance transfers, rewards travel, low-interest, etc.), and card-specific rewards and benefits.

What are the requirements?

American Express does not provide a specific list of requirements, but in order to apply for the card, you must be able to provide the following:

- Industry type

- Years in business

- Annual revenue

- Estimated annual spend

- Tax ID (SSN is acceptable for sole proprietors and LLCs. Corporations and partnerships must provide an EIN)

In addition, while Amex doesn’t provide specific information regarding credit scores, typically, approved applicants have excellent personal credit.

What is the credit score requirement?

American Express does not provide information about minimum credit scores; however, most approved applicants have what’s considered good/excellent. If you’re planning on applying for the , your chances of approval will likely increase if you have a credit score of 740 or higher.

vs — Which is better?

was designed for business owners who spend a significant amount of money on travel expenses; however, it does come with an annual fee of . If you don’t plan to spend a lot of on travel, then the , which has a annual fee, may be a better option.

vs Gold — Which is better?

While both cards can meet your business financing needs, card is not a rewards card. Instead, this card’s primary benefit is their Pay Over Time feature (on eligible purchases). Cardholders can get a 1.5% discount for paying their bill early, or they can have up to 60 days to pay their bill.

If your primary goal is to accumulate and use rewards points, then Gold may be your best option; however, if you’re looking for increased payment flexibility, then you may want to consider .

What is the credit limit?

Many American Express Business cards are offered with “No Pre-set Spending Limit.” No Preset Spending Limit means your spending limit is flexible. Unlike a traditional card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history. Under this policy, cardholders will find that their purchasing power can increase or decrease based on their payment history, credit record, and financial resources as they are known to Amex

This means that, unlike other cards, you do not need to call to request a credit limit increase. Instead, the credit limit is adaptive based on the factors previously mentioned.

Is the a metal card?

Yes. Like the Platinum Business card, the is a metal card.