Conventional wisdom says that people with good credit must all be financially savvy, fiscally responsible sorts with glowing credit reports and beautifully balanced checkbooks.

While that may very well be true of a lot of these people, conventional wisdom is conventional for a reason, and variables like risk-taking, education, adversity, and dumb old luck have a say when it comes to the question of keeping one’s financial house in order.

After all, the flipside of the conventional wisdom under discussion is that people with bad credit must all be financially foolish, fiscally scatterbrained sorts with one eye on their glowing TV screens and the other on their beautifully seasoned microwave dinners.

But this picture may be even less accurate that the previous one. A recent study found that a majority of Americans—at least 56%—are struggling under the burden of subprime credit scores. Many of their stories have a similar, sorrowful ring: living from paycheck to paycheck with no money left over for an emergency fund, credit cards used as a life raft when disaster strikes, credit scores plunge as credit balances soar, and suddenly crippling interest rates lead to late monthly payments. Voila, a subprime credit score is born.

The idea, then, that people with bad credit scores are generally careless, mouth-breathing slugabeds is false. Take me, for example: my wife and I started a small business in 2013. At that time, my personal credit score was well above 700. Our business plan seemed sound, and there was a lot of excitement about our product, but our lack of experience showed. We made some mistakes, got in over our heads, and, long story short, my personal credit score is now floundering in the giardia-infested waters of bad to poor. But it’s not something I neglect, rather it’s something I’m working to improve.

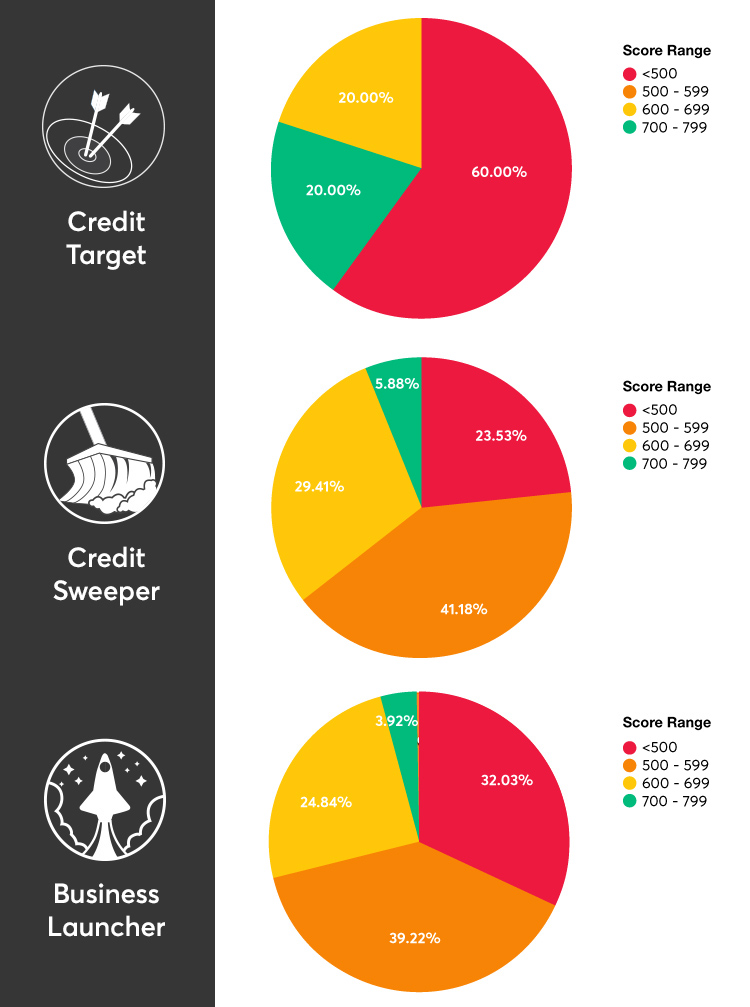

Let’s take a look at the following chart, which represents the Vantage 3.0 credit score distribution of the people that interact with Nav’s tools. These tools are:

CreditSweeper, which helps to find and dispute incorrect information on your personal and business credit reports.

CreditSweeper, which helps to find and dispute incorrect information on your personal and business credit reports.- CreditTarget, which identifies the areas of your credit that need work and then helps you set and achieve your financial goals.

- BusinessLauncher, which guides you through the steps of establishing your business and getting everything in place to build a solid business credit profile.

A quick look at the score distribution reveals that, on average, it’s the ones with bad (500-599), poor (600-649), and fair (650-699) scores that have the ambition and resourcefulness to improve their situation. You’ll see that 60% of CreditTarget users have personal credit scores under 600, or are in the “bad credit” range. Of Nav users who interact with CreditSweeper, almost 65% have credit scores under 600, and a small 6% have scores in the good to excellent range.

You’ll also see that over 70% of Nav users who interact with BusinessLauncher have personal credit scores below 600. This indicates that folks with poor credit are not only interested in building their credit, but are also focused on growing their business to the best of their ability.

According to these numbers, a low credit score clearly isn’t always a sign of irresponsibility and neglect.

It’s time we put to rest the arrogant, ignorant fiction that subpar credit scores are synonymous with subpar people. In the words of Ludwig Wittgenstein, after his older sister had spoken disparagingly of his money woes: “You remind me of someone who is looking through a closed window and cannot explain to himself the strange movements of a passer-by. He doesn’t know what kind of storm is raging outside and that this person is perhaps only with great effort keeping himself on his feet.”

This article was originally written on March 28, 2016 and updated on November 3, 2016.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.