If your business needs an influx of cash before the end of the month, or if you’ve already been denied by a bank, an online term loan can be your next best option.

Funding Circle and StreetShares are two such online lenders that provide loans to small businesses at reasonable interest rates. Both sites claim their qualification process takes 10 minutes to complete, and the money reaches your bank account within 2 weeks — in the case of StreetShares, you could get your money in days.

Instead of the 35%+ Annual Percentage Rates (APRs) on the loans from other short term lenders, APRs rarely rise much over 27%. The catch? The requirements on these alternative loans are tougher — you’ll need a higher credit score and more time in business to qualify. Continue for more on Funding Circle and Street Shares.

Funding Circle

Funding Circle offers loans from $25,000 – $500,000 with 1 – 5 year repayment terms. To qualify for a Funding Circle loan, your business must be 2 years in business (or qualified franchises), produce $150,000+ in annual revenue, the owner must have a personal FICO score of 620 or above and a history free of bankruptcies, current tax liens, judgments or criminal activity. Funding Circle requires collateral on their loans in the form of a lien on your business assets and a personal guarantee from the primary business owners.

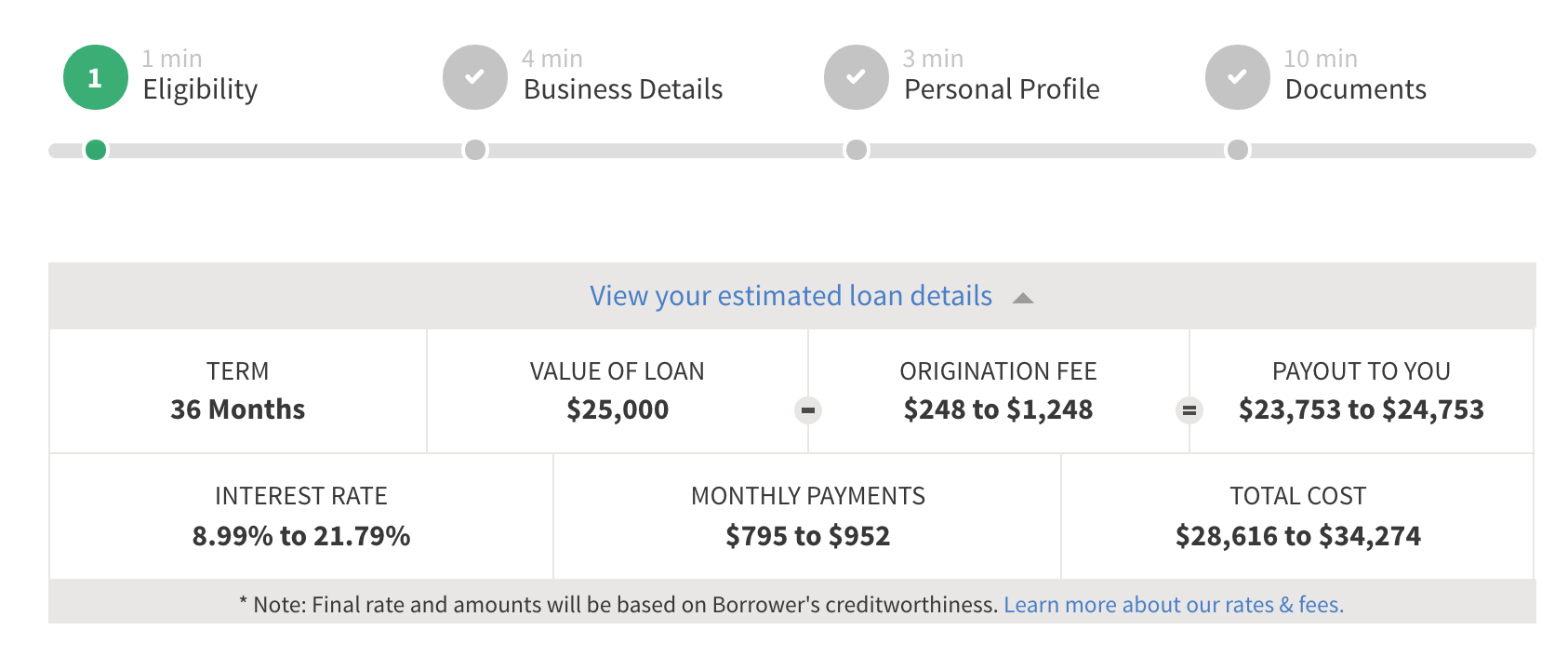

Funding Circle’s interest rates range from 5.49% – 22.79%. Their origination fees range from 0.99% – 4.99%. There is a missed payment fee charged at 10% of the total missed payment, and a $35 insufficient funds fee.

The qualification process is a four step application consisting of your initial eligibility, your business details, personal profile, and documentation.

Post-qualification, you will receive a call from a Funding Circle representative within a couple hours who will inform you of the next steps and additional documentation that must be submitted. You’ll need to provide 3 years of business tax returns, 1 year of personal tax returns, and 6 months of bank statements. If you’re seeking a loan greater than $200,000, you will also need to provide an income statement, and an outstanding business loans and credit worksheet.

Using their cost calculator, we can see that a $75,000 loan with a 1 year term from Funding Circle could cost anywhere from $2,991 – $11,379 depending on the interest rate and origination fees. The highest APR on a loan through Funding Circle is still less than 30%, making them much more reasonably priced than short term lenders.

StreetShares

StreetShares offers loans up to $100,000 with 3 month – 3 year repayment terms. To qualify for a StreetShares loan, your business must be in business 1+ years, it must be incorporated and earning $25,000 in revenue over the past 12 months. The business guarantor must have personal credit 600 or above for established businesses, and 640 or above for emerging businesses.

If your business is less than one year in business but has produced $100K+ in revenue, the one year in business requirement will be waived.

Their rates range from 8% – 35%. On top of the interest you pay to investors, StreetShares charges a 3.95% – 4.95% origination fee, and a $10 late payment fee if you are seven days past the due date.

Using an APR calculator we can see that a $75,000 loan with 1 year repayment term from StreetShares could cost anywhere from $5,592 – $18,679 depending on the interest rate and origination fees.

The application process is two easy steps, all of which StreetShares claims can be completed in 10 minutes. You’ll have to provide information about the business and any owners, as well as the amount requested. You’ll need the following information in order to submit an application: business tax ID, social security #, recent business and personal tax returns, 6 most recent bank statements, and your total outstanding debt and monthly debt payments.

*StreetShares loan information updated on 12/28/16

Which lender works best for you?

| Funding Circle | StreetShares | |

|---|---|---|

| Qualifications | – 2 years in business or qualified franchises – $150K+ in annual revenue – No prior history of bankruptcies, current tax liens, judgements or criminal activity | – In business 1 year – Earning $25K+ in annual revenue – Must be incorporated (can be 1 person LLC) |

| Personal credit score minimum | 620 | 600 for established businesses

640 for new businesses |

| Amount | $25,000 – $500,000 | $5,000 – $100,000 |

| Rates and fees | 5.49% – 22.79% interest0.99% -4.99% origination | 8% – 35% interest

3.95 – 4.95% origination |

| Repayment period | 1 – 5 years | 3 months – 3 years |

| Cost of $75,000 12 month loan | $2,991 – $11,379 | $5,592 – $18,679 |

| Early prepayment penalty | No | No |

| Time to fund | < 2 weeks | days – 1 week |

| Collateral/Personal guarantee | Collateral required: lien on your business assets and a personal guarantee from the primary business owners | Personal guarantee required on loans smaller than $50K. A lien filed on the business assets required for loans above $50K. |

Although Funding Circle and StreetShares have similar price tags, they have significant differences that will help you determine which one is right for your business. For example, if you are two or more years in business and need funds quickly, StreetShares could be a good option for you.

On the other hand, Funding Circle will likely be better if you are more than two years in business and you have an excellent personal credit score. This will help you get close to the lowest interest rate possible, which is 5.49% through Funding Circle. Funding Circle could be a good option for you if you’re in need of a larger (< $100,000) loan amount.

For businesses in need of $75,000 or less, your best bet will be to apply for financing from both Funding Circle and StreetShares, then compare the rates and terms. Exploring these, as well as other online term lending options, will ensure that you get the best bang for your buck.

To see what funding you qualify for based on your credit scores, check out the term loans offered through Nav.

This article was originally written on September 9, 2015 and updated on March 23, 2023.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.