The Offer

We obtained the copy of an offer from OnDeck Capital from a business owner.

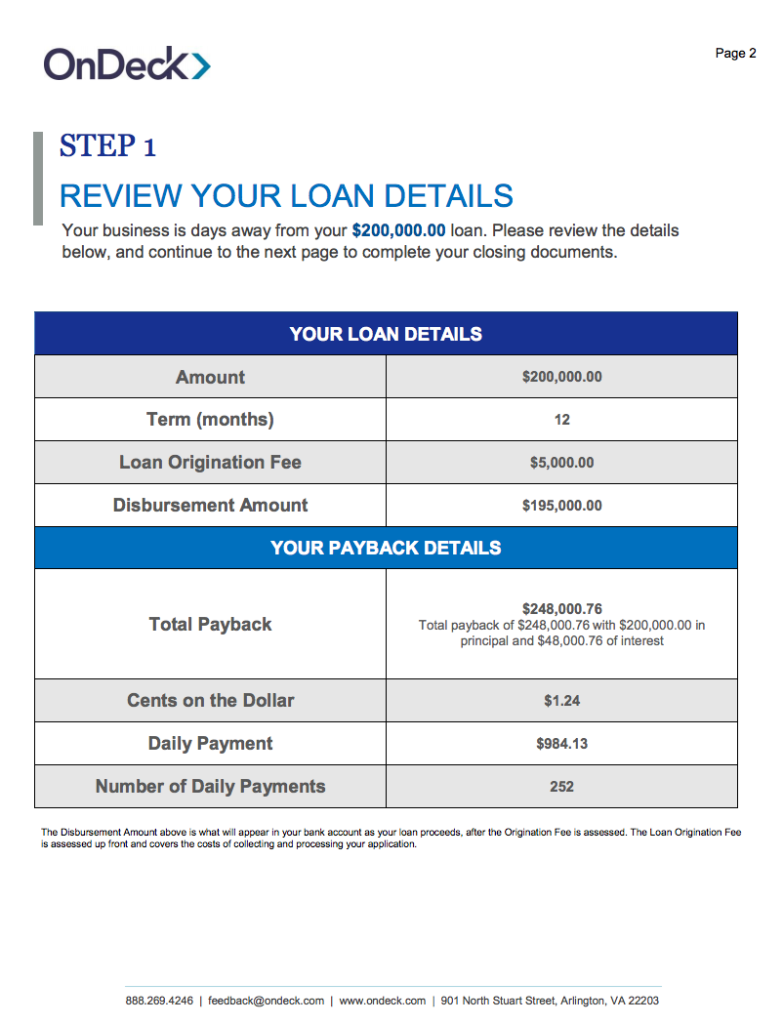

The offer looks a bit different compared to a year ago. Instead of quoting interest rate, it quotes by “cents on the dollar” as shown below.

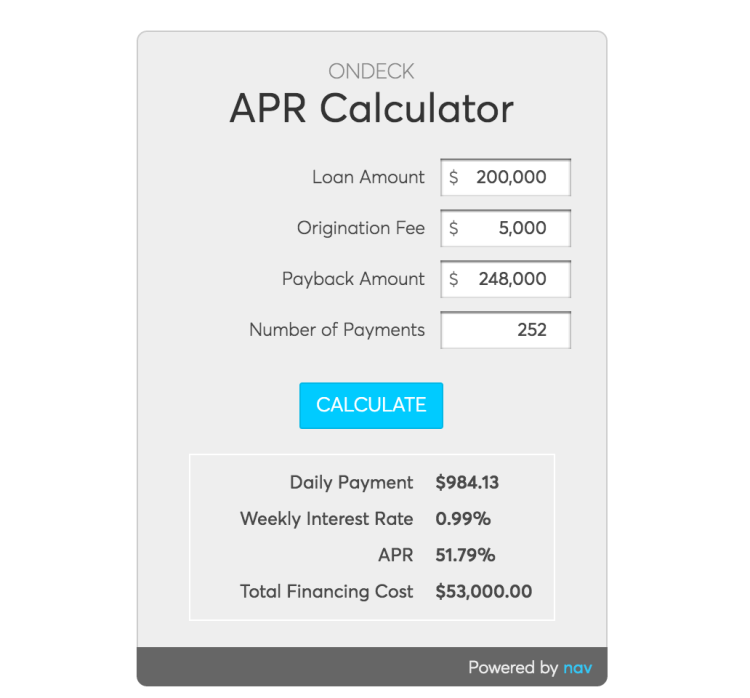

This particular business has millions of annual revenue and is profitable, so he was able to secure a $200,000 loan from OnDeck. An image is worth a thousand words — the following is the APR he is getting from this loan.

The APR he got is 51.79%. It is certainly a lot lower than last year when we decoded an OnDeck loan at 88% APR. But this business is also less risky.

Overall, OnDeck’s APR has been improving. According to their 2014 Q4 press release, the average APR of OnDeck loans originated in the fourth quarter was 51.2%, a decline of over ten percentage points from the prior year period. It’s a good trend and I believe this is happening because (a) their borrowing cost is lower (b) their customer acquisition cost is improving due to the branding and (c) they are facing competitive pressures from other lenders. 50% APR is still insanely high though. The SAME business owner also later obtained a business loan with 13% APR from LendingClub. I suspect OnDeck’s APR will keep going down. Hopefully, it can get to a level that will even allow Nav to comfortably recommend it.

The Attempt to PrePay

Here comes the interesting part of the article. Our borrower asked OnDeck about the prepayment penalty after he read The Hidden Cost of Refinancing Merchant Cash Advances. He was told he will get some discount.

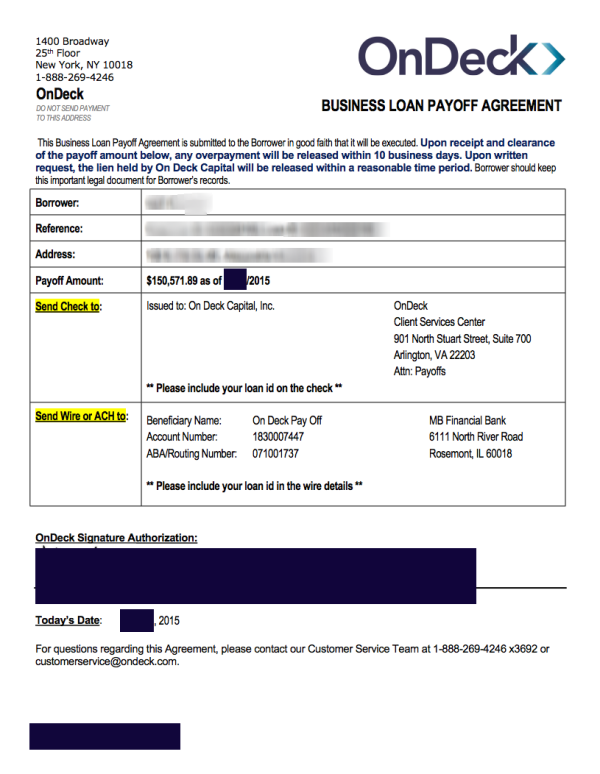

After he got the loan from LendingClub, he wanted to pay off OnDeck. So he asked OnDeck about paying the loan back. OnDeck sent him a letter as shown below but didn’t mention anything about the discount.

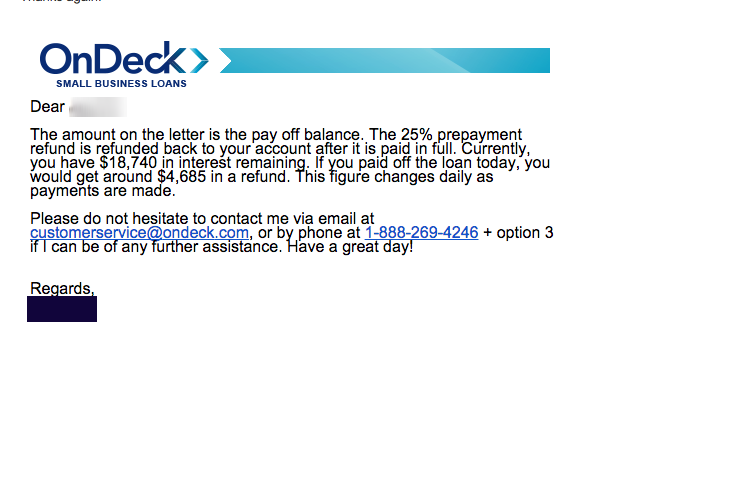

After some quick calculation, it turns out the payoff amount was the total still outstanding on the day of the request! The borrower followed-up with them to get the real payoff amount as that obviously did not include the discount for paying off early. The response he received is the email pasted below. It’s very interesting the way all this is structured:

Let me copy-and-paste what the borrower said about the payoff. Obviously, he got a much better deal from LendingClub so he was not so happy with OnDeck, but I believe his opinion can be useful if you are considering getting a loan from them.

- You are required to pay off everything initially, then you receive a refund. So if you don’t have that cash, you can’t get the 25% discount.

- Since we got no amortization schedule from them, this is the first time we see how front-loaded in interest the loan is. Although we are only 40% paid down, the total discount of $4,685 [Editor’s Note: less than 10% of the total interest of $48,000] is hardly worth the effort. As I’d mentioned, it was difficult for me to get an amortization schedule from them. All I was able to get was a monthly statement showing what interest had been applied to payments made that month. I suppose more astute clients could extrapolate the math to create the amortization schedule for future payments on their own. But this leaves me to wonder how much OnDeck is counting on this lack of transparency to bring in less aware clients who are just happy to get the cash and don’t realize how bad a deal they have with OnDeck, with yet another negative illustrated here: Heavy interest payments in the early part of the payback.

Well, compared to a year ago, there’s some progress. Now, at least OnDeck offers some discount for prepayment. Other short term lenders such as Quarterspot claim that they don’t have prepayment penalty. American Express® Business Line of Credit also offers super reasonable prepayment terms. At the end of the day, I believe consumers will prevail. Hopefully this heavy front-loading will eventually go away.

Conclusions

Compared to a year ago, we see some positive changes for OnDeck’s product. But APR is still high; prepayment penalty is still outrageous. Our advice to business owners who are in need of capital is to ignore the marketing messages and to spend some time shopping around. You can save thousands, if not tens of thousands’ of dollars.

This article was originally written on May 22, 2015 and updated on February 13, 2023.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.