San Mateo, Calif. April 10, 2024 – Nav, the leading financial health platform for small businesses, today announces an all new experience to help business owners better understand and react to their credit health, and use those insights to manage their business and secure better lending options, rates and terms. It comes at a critical time for SMBs.

Small businesses have been hit disproportionately hard by the impacts of inflation, rising interest rates, and tighter lender underwriting in 2023. Based on a recent FICO report, the national average FICO® consumer credit score decreased to 717, marking the first time this metric has dropped in over a decade. Simultaneously, market support for helping SMBs with building business credit are few and far between leaving them alone and unguided, expected to overcome these obstacles while simultaneously trying to run their day to day operations.

Nav Credit Health solves one of the biggest financial literacy challenges for small businesses: understanding their business and personal credit and learning how to improve and utilize their current and future position for funding and growth opportunities. Ryan Lockwood, founder of BCK Ranch, states “A lot of big banks don’t want to fund a new business. They don’t see you as profitable, they don’t see you as anything in your first two years. You just bootstrap. Nav has taken that zero-to-two-year mark and said, ‘Hey, we trust you. We want to build a relationship with you and see that business credit grow through Prime’” According to a research study with Nav’s users, 60% said they are establishing and building business credit before they feel they can grow their business, with only 9% saying they feel like they are in a good place to get funding.

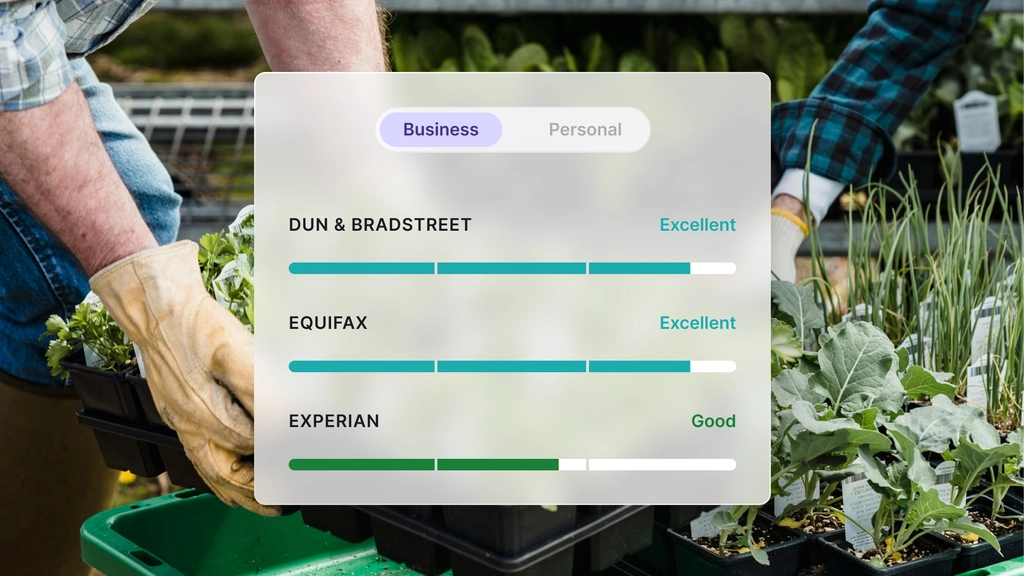

Nav users can now more clearly understand the factors that are most prominently impacting their scores – both business and personal – and can act accordingly on things like paying on time, improving credit utilization, and keeping tradelines reporting to grow their business credit over time. Businesses can then see the impact their score changes have on their eligibility for over 160 financing options. If a business needs to build their business credit history, Nav offers Nav Prime. Nav Prime provides access to the most in-depth view into business and personal credit in the market, as well as ways for businesses to build business credit history with up to two tradelines — including the Nav Prime charge card.

“Nav is dedicated to empowering small business owners by demystifying credit processes, guiding them in improving their credit and financial health profiles, and facilitating access to optimal funding solutions. Our new credit health experience uniquely positions us to assist businesses in not only understanding and enhancing their business credit but also in confidently leveraging their credit health for new growth strategies and funding, all in one place,” said Neha Komma, VP of Product at Nav.

The new credit health experience is the latest enhancement to Nav’s platform all aimed at increasing small businesses’ credit health and eventual access to capital putting them in the best position to thrive and grow.

About Nav

Nav is the leading financial health platform for small businesses. Nav’s unique financial health platform shows cash flow and credit insights alongside suggested financing options, and is the only place small business owners can build and manage business credit and see what financing they can qualify for before they apply.

Nav Technologies, Inc. is a financial technology company and not a bank. Banking services provided by Thread Bank, Member FDIC. The Nav Visa® Business Debit Card and the Nav Prime Charge Card are issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa cards are accepted. See Cardholder Terms for additional details.

Contact

Amanda Triest

PR Manager

Team Nav

Nav is a technology company building the leading small business credit platform. What started as a way for small business owners to easily explore funding has become a destination for over 350,000 small businesses to get everything they need to understand the full picture of where their business's credit stands, and how it can impact their business financial health profile.