The best business credit cards that I can be approved for

Ben Luthi

Summary

- Business credit cards are available for various credit profiles, including those with limited credit history.

- Options include secured cards and those with rewards tailored to business expenses.

- Selecting the right card can help build business credit and manage cash flow effectively.

Editorial note: Our top priority is to give you the best financial information for your business. Nav may receive compensation from our partners, but that doesn’t affect our editors’ opinions or recommendations. Our partners cannot pay for favorable reviews. All content is accurate to the best of our knowledge when posted.

Getting a good business credit card is a great way to build a business credit history and get some benefits and rewards along the way. But depending on your personal credit history, it can be tough to get the card you want.

Before you apply for any business credit card, it’s a good idea to check your credit score first. Once you know it, then you can apply for a card that you have a good chance of getting approved for.

To help you, we’ve put together a list of some of the best credit cards for each type of credit score on the spectrum.

Best for bad credit

Wells Fargo Business Secured Credit Card

If your credit score is between 300 and 579, or you’ve never used credit before, your best bet may be a secured credit card. Of the handful of business secured credit cards out there, the Wells Fargo Business Secured Credit Card is hands-down the best.

The card allows you to choose between 1.5% cash back on all purchases or 1 point per dollar on all purchases, plus 1,000 bonus points for every month where you spend at least $1,000.

Your credit limit will be equal to your security deposit, which can be between $500 and $25,000. The annual fee is $25 per card, which can get expensive if you add employee cards. But depending on how often you use it, the rewards can make up for the cost.

As you use the card responsibly over time, Wells Fargo will review your account periodically to determine whether to upgrade you to an unsecured account.

*All information about the Wells Fargo Business Secured Credit Card credit card has been collected independently by Nav. This card is not currently available through Nav. To see what business credit cards are available, please visit the Nav Credit Card Marketplace.

Best for excellent credit

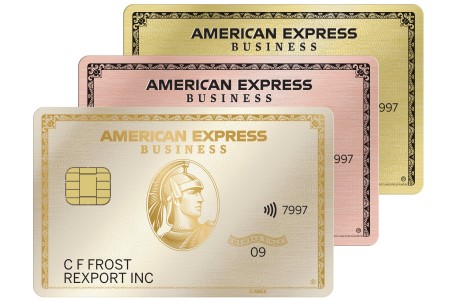

American Express® Business Gold Card

If your credit score is 740 or higher and you value flexibility and great benefits, the American Express® Business Gold Card is tough to beat.

Earn 4X Membership Rewards® points on the top two eligible categories where your business spends the most each month from 6 eligible categories. Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.*When it’s time to redeem your points, you have a lot of options, including getting gift cards or cash back, booking travel, or transferring them to airline and hotel partners.

Keep in mind, though, that the card charges a $375 annual fee. But if you take advantage of the card’s benefits, you could get far more value than that in the first year alone.

High annual fee, best for large purchases in consistent categories.

Pros

- This card has a great rewards program and offers flexibility compared to true charge cards.

Cons

- High annual fee

- Only 1x rewards outside of your top categories.

Intro APR

Purchase APR

Annual Fee

Welcome Offer

Picking the right card for you

Knowing your credit score is an important component of getting the right credit card for your business. But also knowing what you want in a card can help you make the right decision.

Take some time to research these cards and compare them to other top business credit cards in the same credit range. This process can take time, but it’s well worth it if you’re able to get more value in the long run.

Access better funding options with a solution you can’t get anywhere else

Improve your business’s financial health profile, unlock better financing options, and get funded — only at Nav.

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Get the Main Street Makers newsletter

Rate this article

This article currently has 2 ratings with an average of 5 stars.

Ben Luthi

Ben Luthi is a personal finance and travel writer who loves helping consumers and business owners make better financial decisions. His work has appeared in several publications and websites, including U.S. News & World Report, USA Today, Marketwatch, Yahoo! Finance, and more.