What small businesses should know about inflation and rising costs in 2026

Gerri Detweiler

Education Consultant, Nav

Summary

- Inflation raises the cost of supplies, rent, and services, shrinking your business's purchasing power and profit margins if revenue doesn't rise accordingly.

- Supply chain disruptions, labor shortages, and government policies drive inflation and affect how you price products and manage operations.

- Fear about inflation is high among small business owners.

- Monitoring inflation trends and adjusting pricing, budgeting, and vendor relationships can help you stay resilient through economic shifts.

Editorial note: Our top priority is to give you the best financial information for your business. Nav may receive compensation from our partners, but that doesn’t affect our editors’ opinions or recommendations. Our partners cannot pay for favorable reviews. All content is accurate to the best of our knowledge when posted.

More than 70% of small business owners think prices will continue to rise, according to the CNBC and SurveyMonkey's quarterly small business survey published in October 2025.

This guide covers what you need to understand inflation's potential impact on your business, assess the financial health of your business, and implement strategies to protect and grow your company in 2026.

Track your business and personal credit for free

Get a clear view of your business and personal credit standings with a free Nav account. See your credit grades across major business bureaus to know where you stand today.

What is inflation and how does it work?

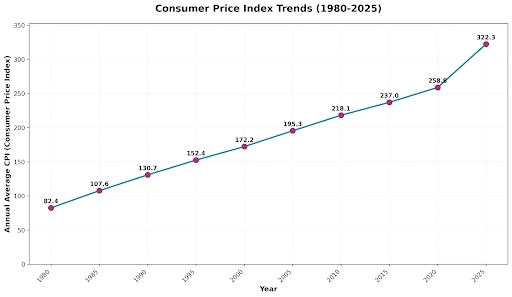

Inflation is when prices for goods and services go up across the board rise at the same time and continue to rise over time. The government measures inflation using the Consumer Price Index (CPI). The CPI tracks the prices of common items people buy, like food, gas, and clothing. When these prices rise faster than normal, we say inflation is high.

Here’s a way to think about inflation: When one of your suppliers raises prices on a key item, that’s not necessarily inflation. But when “everything” your business buys from various suppliers starts getting more expensive, that would likely be considered inflation.

Inflation itself can feel like an abstract concept, but what often feels more concrete is purchasing power. Higher sustained prices from inflation means the same amount of money buys less than it did before. This concept is called purchasing power.

Here’s how to think about purchasing power: If you had $100 in 2020, it may have bought you 10 bags of flour for your bakery. By 2025, that same $100 might only buy 8 bags because prices increased. Your business still has $100, but your purchasing power dropped by 20%.

For small business owners, inflation may mean supplies, rent, services, and other costs are more expensive. And that can be tough for small businesses.

What is the current inflation rate?

For December 2025, the inflation rate in the US stood at about 3%, according to forecasts by the Cleveland Fed. This sits slightly above the Federal Reserve's target rate of 2%.

Keep in mind that inflation rates vary by industry and location. Industries such as construction and transportation tend to be hit hard by inflation, for example. Similarly, regions dependent on imported goods may face different price pressures than those using domestic supplies.

Source: Federal Reserve Bank of Minneapolis

What is driving inflation and rising costs for small businesses?

Inflation occurs when prices go up across many areas of the economy around the same time, and stay up. For small business owners, this often means higher costs for the things you need to run your business.

Economists often point to three main factors that drive inflation: supply, demand, and monetary policy.

Let's look at the specific forces driving inflation and rising costs for small businesses in 2026.

1. Supply chain disruptions

Supply chain issues continue affecting businesses across industries, though in different ways than during the pandemic. These supply chain disruptions can lead to longer lead times for specialized equipment and materials, higher shipping costs due to fuel prices and transportation capacity constraints, increased inventory costs as businesses stockpile to avoid shortages, among other issues.

A retail business might have to order holiday inventory in July instead of September, due to fears of delays. This can tie up cash earlier and increase storage costs.

A restaurant might switch suppliers mid-contract when their primary vendor can't meet delivery schedules, often paying premium prices that come with a new contract and having to deal with a new supplier.

2. Labor market pressures

The labor market is in flux in 2026. USA Today Money reports that job cuts are at a five year high and new hirings have hit the lowest levels since 2009. There is also some research and news pieces suggesting new grads are having a hard time getting a job.

This suggests there are perhaps opportunities to get both experienced and new workers/graduates at a salary that fits your small business, but inflation is hitting workers too. It is hard for workers experiencing the same loss of purchasing power as the small business owner to live on lower wages.

Workers may be looking for higher salary positions to make up for this loss of purchasing power. If you can’t offer raises, consider other benefits such as remote/hybrid work, store discounts, more vacation time, or a four-day work week.

3. Government policy and interest rates

Federal Reserve decisions affect small businesses in multiple ways. Interest rates impact your costs when you carry balances on business credit cards, need equipment financing or term loans, or refinance existing debt.

When the Fed raises rates to combat inflation, borrowing becomes more expensive. This affects your ability to invest in growth, upgrade equipment, or manage cash flow gaps.

Government policies on taxes, trade, and regulation also influence your operating costs. Tariffs on imported goods raise prices for businesses that rely on international suppliers. Changes to tax policy can affect your net income and cash available for operations.

4. Another factor: monopolies

There is growing concern that large monopolies in the US are making it difficult, or sometimes impossible, for small businesses to compete. Stacy Mitchell, the co-director of the Institute for Local Self Reliance writes:

“Nearly every industry has become highly concentrated. Small, independent businesses are increasingly few and far between. Although startups are integral to Americans’ self-image as a nation, concentrated corporate power and policies that favor big firms have made the economy increasingly inhospitable to the creation of new businesses.”

What does this have to do with inflation?

Monopolistic businesses may have little incentive to lower their prices because customers can’t effectively shop for a lower price. These monopolies extend to both consumer goods and the products small business owners rely upon. For example, More Perfect Union writes that one restaurant supplier is growing both in market power and profits, while restaurants feel forced to absorb higher costs.

How does inflation affect business owners?

Business owners are typically affected by inflation in three key ways:

- Their cost of living may go up (business owners are consumers too)

- Their business operating expenses often increase

- Their customers may have less purchasing power

Inflation can hit small business owners — especially solopreneurs and those with small teams — particularly hard.

When prices go up, your business costs increase across multiple categories:

- Supplies and raw materials

- Rent and facilities

- Utilities

- Labor

- Shipping and logistics

If you can't raise your prices to match these increases, your profit margins shrink. This makes it harder to keep up with bills, invest in your business, or pay yourself a consistent salary.

For those already stretched thin on time and resources, inflation adds another challenge. You might find yourself working longer hours to make ends meet or putting off important business improvements.

Here's what this looks like in practice.

Before inflation impact:

- Monthly revenue: $50,000

- Cost of goods sold: $20,000 (40%)

- Operating expenses: $20,000 (40%)

- Net profit: $10,000 (20%)

After 6% cost inflation (without price increases):

- Monthly revenue: $50,000

- Cost of goods sold: $21,200 (42.4%)

- Operating expenses: $21,200 (42.4%)

- Net profit: $7,600 (15.2%)

Your profit dropped 24% while you worked just as hard. That $2,400 monthly difference adds up to nearly $29,000 annually — money that could have gone toward equipment upgrades, hiring help, or building reserves.

While you can't control inflation, understanding how it affects your business helps you make smarter decisions about pricing, spending, and planning for the future.

How to assess your business financial health during high inflation

Keeping tabs on your business finances is always important, but it's especially crucial during times of high inflation.

Review cash flow

Start by reviewing your cash flow regularly. Look at how much money is coming in and going out each month. Are your expenses rising faster than your income? This can help you spot potential problems early.

Track your cash flow

Get the insights you need to take action and improve your business cash flow.

Examine profit margins

If your costs are going up due to inflation, are you still making enough profit on each sale? Calculate your gross profit margin (sales revenue minus cost of goods sold, divided by sales revenue) and your net profit margin (net income divided by sales revenue). If these numbers are shrinking, you might need to adjust your pricing or find ways to cut costs.

Assess your debt

Sometimes high inflation leads to interest rate cuts, which may make borrowing less expensive. You may want to look at whether it makes sense to refinance your business loans.

Check business credit

Strong business credit scores may help your business qualify for better financing options, lower insurance premiums, or even land new business.

Business credit reports from Dun & Bradstreet (D&B), Experian, and Equifax help lenders and vendors evaluate your business's creditworthiness. If you aren't sure how business credit works, learn how to establish business credit to build a foundation for future financing needs.

Build cash reserves

Finally, evaluate if your business has enough cash reserves to handle unexpected expenses or a temporary dip in sales. It may be easier said than done, but a good rule of thumb is to have enough savings to cover at least three to six months of expenses.

If not, consider adjusting your pricing, reducing expenses, or securing backup financing like a line of credit or business credit card. Be careful you don't fall into the trap of using financing to make up for low sales or a failing business strategy.

Financial health assessment checklist

Track these metrics monthly to stay on top of your business's financial health:

- Cash flow: Money in vs. money out, with a 30-day and 90-day trend

- Gross profit margin: Means maintaining healthy margins on products/services

- Net profit margin: What's left after all expenses

- Accounts receivable aging: How quickly customers are paying?

- Debt-to-income ratio: How comfortably you can handle your debt payments

- Business credit scores: Check credit scores such as Dun & Bradstreet PAYDEX®, Experian Intelliscore PlusSM, Equifax Business Delinquency Score®

- Cash reserves: Target number of months of operating expenses covered

- Cost per unit or service: Measure whether prices are keeping pace with rising costs

You can run these numbers with your accounting software or a simple spreadsheet. Try to review them on a regular schedule so you catch trends before they become problems.

7 cost-cutting strategies for businesses facing rising costs

When inflation drives up your business costs, finding ways to cut expenses becomes crucial. Here are strategies to help keep your business healthy:

1. Review and adjust your business model

Look for ways to make your business more efficient without sacrificing quality.

If you have a service-based business, consider productizing your expertise. A consultant who charges $200/hour for one-on-one time might create a $497 online course that serves 50 clients with the same information. The course takes 40 hours to create but generates $24,850 with no additional time investment per student.

For businesses with physical products, explore drop shipping arrangements where you don't hold inventory. A boutique owner might keep bestsellers in stock but drop ship specialty items directly from wholesalers, cutting storage costs and inventory risk.

Consider offering virtual services instead of in-person ones to save on travel or office space costs. A fitness trainer might charge $75 for in-person sessions but offer $55 virtual sessions that require no commute time and allows for back-to-back bookings.

Look at your return on investment for each change. If automation software costs $200/month but saves 10 hours of work valued at $50/hour, you're gaining $300 in value monthly.

2. Negotiate with vendors

If the cost of your supplies or inventory has gone up, talk to your suppliers. Keep in mind their costs may have increased too, but there's often room to negotiate.

Ask about bulk discounts. Buying more at once might lower your per-unit cost. A bakery spending $2,000 monthly on flour might get a 12% discount by committing to $24,000 annually paid upfront, saving $2,880 yearly.

You may also want to request better payment terms. If you have good business credit or you're a client in good standing, longer payment terms can help with cash flow. Moving from net-15 to net-30, for example, gives you an extra two weeks of cash on hand.

Shop around and get quotes from other vendors. You might find better deals or use these quotes to negotiate with your current suppliers.

Try this negotiation approach:

"I value our partnership and want to continue working together. My costs have increased significantly this year, and I'm looking for ways to manage expenses. Could we discuss options like [bulk discounts/extended terms/quarterly contracts] that would help both of us?"

Most vendors prefer keeping good customers over finding new ones. The worst they can say is no.

3. Review your current business expenses

Take a close look at where your business is spending money. Analyze the profit margins on your products or services. You may want to discontinue less profitable products or double down on the most profitable ones.

Run a monthly expense audit using these categories:

- Essential and efficient: Keep these

- Essential but expensive: Negotiate or find alternatives

- Nice to have: Reduce or eliminate

- Unnecessary: Cancel immediately

A restaurant might find they're spending $400 monthly on a premium reservation system when a $50 alternative would work fine. That's $4,200 annual savings.

4. Optimize your inventory

If your business sells products and maintains inventory, analyze it regularly. Inventory management software can help you reduce overstocking or cut storage costs.

Consider these tools for better inventory management:

- inFlow Inventory: Good for small businesses with complex inventory needs ($129-$349/month for small businesses)

- Sortly: Simple visual inventory system for smaller operations ($0-$149/month)

The right system pays for itself by preventing stockouts (lost sales) and overstock (tied-up cash and storage costs).

5. Embrace technology

Look for technology that makes your business more efficient:

Marketing tools:

- Buffer or Hootsuite for social media scheduling: Plan a month of posts in one afternoon instead of daily posting

- Mailchimp or Constant Contact for email marketing: Automate customer follow-ups and promotions

- Canva for design: Create professional graphics, social media posts, and more

AI tools for efficiency:

- ChatGPT or Claude for content drafts: First drafts of emails, social posts, and blog outlines

- Grammarly for writing: Catch errors and improve clarity

- Otter.ai for meeting transcription: Capture action items without manual note-taking

Communication tools:

- Zoom or Google Meet for video calls: Skip the commute for many meetings

- Slack or Microsoft Teams for team messaging: Reduce email overload and speed up responses

- Calendly for appointment scheduling: Eliminate scheduling email back-and-forth

Each tool should save you more time or money than it costs. A $20/month social media scheduler that saves you 5 hours monthly is worth $100+ if you value your time at $20/hour.

6. Reduce labor costs (without layoffs)

Labor is often one of your biggest expenses, but you may not have to lay people off to manage costs.

Cross-train employees so team members can cover multiple roles. A restaurant where servers can also run host duties or prep simple items needs fewer staff during slow periods.

Offer flexible work arrangements. Remote work can reduce office space needs. Compressed schedules (like four 10-hour days) might cut overtime. Some businesses offer unpaid time off during slow seasons with a guaranteed return date.

Use freelancers or contractors for specialized projects instead of hiring full-time staff. A marketing agency might keep core staff and bring in freelance designers, writers, and developers as client work requires.

The key to maintaining morale: Communicate clearly why you're making changes and involve employees in finding solutions. People accept change better when they understand the reasoning and feel heard.

7. Leverage financial products

Shopping for financial products may reduce your costs:

- Business credit cards with rewards: Earn 1%–5% back on business purchases you're already making. If you spend $5,000 monthly on a card with 2% cashback, that could be up to $1,200 annually in cash back rewards.

- Merchant processing fee negotiation: If you process credit cards, shop rates annually. Switching processors might save 0.5%–1% on transactions. For a business processing $100,000 annually, that could be as much as $500–$1,000 in savings.

- Refinancing debt: If you have business debt and your credit has improved or rates have dropped, refinancing your rate from 12% to 8% on a $50,000 loan could save your business up to $2,000 annually.

- Business banking: Some banks charge monthly fees, transaction fees, and minimum balance requirements. Switching to a free business checking account might save up to $200–$500 annually.

Here's a comparison for different financial products:

Product | Best for | Watch out for |

Daily purchases, building credit, earning rewards | High interest if you carry a balance | |

Managing cash flow gaps, seasonal businesses | Interest charges when you carry balances | |

Major purchases, expansion, equipment | Long-term commitment, qualification requirements | |

Emergency funding, but expensive | High costs, daily payments |

Note: Nav is not a lender or a credit bureau. Credit information is provided by third-party sources. These examples are for illustrative purposes and not all business owners will achieve these savings.

7 ethical ways to increase profit during these times

Raising prices during inflation can feel uncomfortable, but it's often necessary for business survival. The key is doing it ethically and thoughtfully.

1. Be transparent

Let customers know why prices are increasing. Most people understand that your costs have gone up too.

Try this messaging:

"Like many businesses, we've seen significant increases in [specific costs: ingredients, materials, shipping]. To continue providing the quality and service you expect, we're adjusting our prices by [percentage] starting [date]. We appreciate your understanding and continued support."

Email this to existing customers before the increase takes effect. Post it on your website and social media. Answer questions directly and honestly.

People respect transparency. What frustrates customers is surprise price increases with no explanation.

2. Grandfather in existing customers

If you have subscription services or long-term contracts, consider keeping current customers at their existing rate for a period while charging new customers the higher rate.

A software company might tell current subscribers: "Your rate stays at $49/month for the next 12 months. New customers will pay $59/month starting next week."

This rewards loyalty, gives customers time to adjust, and makes them less likely to shop around for alternatives.

Examples of businesses doing this well:

- Streaming services that grandfather legacy plans

- Gym memberships that honor founding member rates

- B2B services that maintain contract rates until renewal

3. Add value

Before raising prices, look for ways to add value so customers feel they're getting more for their money.

Ideas for adding value without major cost:

- Add an educational component: Quick tips, how-to guides, or exclusive content

- Improve the experience: Better packaging, faster service, more personalized attention

- Include extras: A retail store might add free gift wrapping. A consultant might include a follow-up check-in call.

- Create a loyalty program: Points, discounts for referrals, or exclusive access

- Extend your guarantee: Longer warranty or satisfaction guarantee period

- Offer more flexibility: Easy rescheduling, payment plans, or customization options

- Build community: Create a Facebook group, host events, or facilitate connections between customers

Value additions work best when they cost you little but mean a lot to customers. A hairstylist offering complimentary hand massages during services adds significant perceived value for minimal cost.

4. Use tiered pricing

Instead of one price increase across the board, create pricing tiers so customers can choose their price point.

A photographer might offer:

- Basic package: $800 (2 hours, 50 digital photos)

- Standard package: $1,200 (4 hours, 100 photos, online gallery)

- Premium package: $2,000 (8 hours, unlimited photos, album, online gallery)

Tiered pricing psychology: Most customers choose the middle option. Price your tiers so your most profitable offering sits in the middle, making it the obvious best value.

This approach lets price-sensitive customers stay with you at a lower tier while customers who want more can pay for premium service.

5. Step up prices slowly

Raising prices by 30% all at once shocks customers. Increasing by 5%–8% twice over 18 months feels more manageable.

Recommended approach:

- Calculate the total increase you need

- Split it into 2–3 smaller increases

- Space increases 6–12 months apart

- Communicate each increase in advance

If you need to raise prices from $100 to $125, go to $108 now, $117 in 8 months, and $125 in 16 months. Each increase feels smaller and more acceptable.

The exception: If your costs jumped suddenly and significantly, one larger increase with clear explanation may be better than multiple increases that make customers feel you're nickel-and-diming them.

6. Bundle offers

Bundling encourages larger purchases while maintaining your margins.

A landscaping company might bundle:

- Spring cleanup + mulching = $400 (vs. $250 + $200 separately)

- Monthly mowing + quarterly fertilization = $199/month (vs. $160 + $60 separately)

Bundle pricing works because customers perceive they're getting a deal even though you're maintaining or improving margins on the package deal.

Calculate bundle pricing by:

- Determine costs for each component

- Add your normal markup

- Discount the bundle 10%–20% from buying items separately

- Ensure bundle margins still hit your profit targets

7. Time it right

Some timing strategies for price increases:

- For holiday-dependent businesses: Raise prices after your busy season ends. A toy store increases prices in January, not November. Customers already spent their holiday budget, and by next season they'll barely remember the old price.

- For B2B companies: Align increases with contract renewals or budget cycles. Corporate customers build your new pricing into next year's budget without disruption.

- For subscription businesses: Implement increases at the start of the quarter or year. January 1 feels natural for changes and aligns with when many people review their subscriptions.

- For project-based work: Raise prices for new projects while honoring quotes already provided. Tell prospects: "This quote is good for 30 days. Our rates are increasing February 1."

Track your business and personal credit for free

Get a clear view of your business and personal credit standings with a free Nav account. See your credit grades across major business bureaus to know where you stand today.

How to find alternative revenue streams

Creating additional income sources can help your business weather inflation and provide stability when your primary revenue stream slows down.

1. Analyze your strengths

What do you already do well that customers value?

Ask yourself:

- What questions do customers ask repeatedly?

- What aspects of your business do people compliment?

- What skills or knowledge set you apart from competitors?

- What resources do you have that sit idle part of the time?

A graphic designer might notice clients always ask about brand strategy. That's an opportunity for a separate consulting service. A restaurant with a slow lunch period might offer cooking classes at 2pm when the kitchen isn't busy.

2. Listen to your customers

Pay attention to what customers request but you don't currently offer.

Methods for gathering feedback:

- Send a simple survey asking what they wish you offered

- Monitor social media comments and messages

- Review customer service inquiries for patterns

- Ask during checkout: "Is there anything else we could help you with?"

- Track what customers buy from competitors

A yoga studio that hears "I wish I could practice at home" might create a subscription video library. A hardware store hearing "I don't know how to install this" might offer installation services.

3. Explore digital products

Digital products require upfront work but can generate income with minimal ongoing costs. Here are some digital product ideas by business type:

For consultants and coaches:

- Online courses teaching your expertise

- Templates (contracts, worksheets, plans)

- Video tutorial library

- Downloadable guides or e-books

For retail businesses:

- How-to videos for using products

- Care guides and maintenance plans

- Curated product recommendation guides

For service businesses:

- DIY versions of your service

- Planning tools and checklists

- Educational content on industry topics

Realistic timeline and effort:

- A 1-hour course: 20–40 hours to create, plan, record, and market

- A 50-page e-book: 30–60 hours to write, design, and publish

- Template pack: 10–20 hours to create and package

Don't expect immediate income. Most digital products take 3–6 months to gain traction and require ongoing marketing.

4. Offer subscriptions

Subscriptions provide predictable recurring revenue. Here are some subscription model examples across industries:

- Landscaping: Year-round service plan for lawn and seasonal work

- Coffee shop: Daily coffee subscription at a discounted rate

- Bookstore: Monthly book box with curated selections

- IT services: Managed services contract with fixed monthly fee

- Pet grooming: Subscription for monthly grooming at reduced rate

- Cleaning service: Weekly or bi-weekly recurring service plan

Start small. Offer subscriptions alongside your regular services and adjust based on what works.

5. Partner with other businesses

Strategic partnerships can open new revenue without major investment. Here are a few examples:

Referral fees: A wedding photographer refers clients to a florist and earns 10% of each booking. The florist refers back. Both gain customers and income.

Revenue sharing: A fitness trainer partners with a nutritionist to offer combined packages. They split revenue 60/40 based on who led the sale.

Co-marketing: A bookstore and coffee shop share email lists and offer joint promotions. Each drives traffic to the other without spending on ads.

Bundled services: A web designer partners with a copywriter and branding consultant to offer complete packages. They split fees and handle their specialized parts.

Look for businesses that:

- Serve the same customers but offer different services

- Share your values and quality standards

- Don't compete with you directly

- Have similar business sizes so the partnership feels balanced

6. Rent out assets

Many businesses have assets that sit unused part of the time. These may include:

- Kitchen equipment: A bakery rents out commercial kitchen space overnight to a meal prep business

- Office space: A consulting firm rents desks to remote workers on days they're meeting with clients off-site

- Equipment: A landscaping company rents lawn equipment on weekends to homeowners

- Vehicles: A delivery business rents vans on Sundays when they don't operate

- Photography studio: Rent space by the hour to other photographers

- Event space: A restaurant rents its dining room for private parties on closed days

- Tools and machinery: Construction equipment, cameras, sound systems

Calculate rental pricing by:

- Determine hourly/daily ownership costs (payments, maintenance, insurance, depreciation)

- Add a profit margin (typically 30%–50%)

- Check what competitors charge for similar rentals

- Price competitively while ensuring profitability

7. Create a referral program

Turn satisfied customers into a revenue stream. Consider these referral incentive structures:

For B2B services

- $500 cash or service credit per qualified lead that becomes a customer

- 10% of first-year contract value

- Tiered rewards: $250 for first referral, $500 for second, $750 for third+

For retail businesses

- $20 store credit for referrer, $10 discount for new customer

- Every 5 referrals earns a $100 gift card

- Points system where referrals earn double points

For service businesses

- One free service for every three paying referrals

- 20% off next appointment for each referral who books

- Enter referrers into quarterly drawing for gift cards

Tracking methods

- Unique referral codes for each customer

- Simple form on your website for referrals to mention who sent them

- Track in your CRM or a spreadsheet

- Apps like ReferralCandy or Friendbuy for automated tracking

Make it easy. Give customers a specific way to refer (referral cards, shareable links, simple explanations they can copy-paste) and remind them regularly that you appreciate referrals.

Quick action checklist for small business owners

Here are some actions you to consider right now to help protect and grow your business during inflation:

- Assess your financial health: Review your cash flow, profit margins, debt levels, and business credit scores. Know where you stand before making decisions.

- Analyze your pricing: Calculate if your current prices cover rising costs. If not, develop a plan to increase prices strategically over the next 6-12 months.

- Review expenses: Identify your top 10 expenses and find at least one area where you can negotiate better terms or find a less expensive alternative.

- Build cash reserves: Set a goal to save enough to cover 3-6 months of expenses. Start by saving 1% of revenue monthly if you're starting from scratch.

- Strengthen business credit: Check your business credit reports with major business credit reporting agencies and work on improving factors that can boost your scores, such as getting accounts that report and paying on time.

- Explore new revenue: Identify at least one new revenue stream you could test in the next 90 days based on your existing strengths and customer needs.

- Invest in efficiency: Choose one productivity tool or process improvement that could save you at least 2 hours weekly and implement it this month.

Don't passively wait for economic conditions to improve. The businesses that take action during challenging times are often the ones that end up thriving.

How to build general business resilience

Business resilience means your company can bounce back from setbacks and keep operating, even when things get tough. It's about being prepared for unexpected events and having the flexibility to adjust your business practices when needed.

A good way to approach it is with a risk assessment. This means identifying potential threats and developing plans to handle them.

1. Conduct a business risk assessment

Start by listing potential risks to your business across these categories:

Financial risks

- Loss of a key customer

- Unexpected expenses

- Economic downturn affecting sales

- Debt service challenges

Operational risks

- Supply chain disruptions

- Equipment failure

- Key employee departure

- Technology failures or cybersecurity issues

Market risks

- New competitors

- Changing customer preferences

- Industry disruption (like AI affecting your business model)

- Regulatory changes

External risks

- Natural disasters

- Public health emergencies

- Political instability

- Rapid inflation

For each risk, assess:

- Likelihood: How probable is this? (Low/medium/high)

- Impact: How much would this hurt your business? (Low/medium/high)

- Current preparation: What safeguards do you have now?

- Mitigation plan: What else could you do to prepare?

Focus your energy on high-likelihood, high-impact risks first.

Simplify your bookkeeping

That’s a lot of receipts. Get easy-to-use bookkeeping tools with Nav Prime. Create instant profit & loss statements, automatically categorize transactions, and track all your accounts in one place.

2. Build financial resilience

Financial stability gives you more options when facing challenges. With more options, you’ll feel less pressure.

Cash reserves

Aim for enough savings to cover at least three to six months of expenses. Start by saving 1% of revenue monthly if building reserves from scratch.

Access to credit

Establish business credit and maintain relationships with lenders before you need emergency funding. Good business credit may help open doors to financing or other opportunities. Having a business credit card or line of credit you can tap quickly provides access to funding that may be critical for emergency needs.

Diversify income sources

Not relying on just one product, service, or customer for all your revenue protects you if one source dries up.

Manage debt wisely

Keep debt payments manageable. A good rule: try not to let your total debt service exceed 30% of monthly revenue.

3. Diversify your business model

Create multiple ways to generate revenue so you're not dependent on a single source. Here are some examples:

- A fitness studio offers classes (primary revenue) plus personal training, nutrition coaching, and online memberships

- A contractor handles new construction (main business) but also offers repair services and maintenance contracts for steady income during slow periods

- A restaurant serves dine-in customers but adds catering, meal kits, or cooking classes

Customer segment diversification:

- A B2B software company serves both small businesses and medium-sized businesses

- A graphic designer works with local businesses and non-profit organizations

- A manufacturer sells direct to consumers, through retailers, and via wholesale distributors

If one segment struggles, others can keep your business afloat.

4. Strengthen key relationships

Strong relationships provide support during difficult times.

- Suppliers: Build good relationships with multiple suppliers. When one has supply issues, others may be able to fill the gaps. Treat vendors well and they'll prioritize your orders during shortages.

- Customers: Deep customer relationships create loyalty that survives price increases and market changes. Stay in regular contact, deliver excellent service, and show appreciation.

- Community: Engage with your local business community, chamber of commerce, and industry groups. These connections often lead to referrals, partnerships, and support during tough times.

- Mentors and advisors: Build a team of people who can guide you through challenges. Consider getting a mentor through SCORE or your Small Business Development Center (SBDC). Find a business mentor here.

How to use inflation reports to stay updated (and where to find them)

Most business owners pay close attention to metrics that directly impact their business: cost of raw materials, labor, and taxes. Still, monitoring broader economic indicators like interest rates and inflation may be helpful too, in your decision-making process.

The effects of inflation and other economic factors often directly impact your business operations and profitability. But just as importantly, they affect your personal finances and those of your employees and customers. When people feel pinched by rising costs, it affects job performance and spending habits.

Key economic indicators to monitor

Consumer Price Index (CPI)

The Bureau of Labor Statistics publishes monthly updates showing how prices change for consumer goods and services. This tells you if your customers are facing increased costs that might affect their spending.

Where to find it: Bureau of Labor Statistics Consumer Price Index reports

What to look for: Month-over-month and year-over-year changes in overall CPI and specific categories relevant to your business. Rising food costs affect restaurants. Increased housing costs mean customers have less discretionary income.

Producer Price Index (PPI)

Tracks price changes for goods at the wholesale level before they reach consumers. This often predicts CPI changes and directly affects businesses that buy supplies.

Where to find it: Bureau of Labor Statistics Producer Price Index reports

What to look for: Your industry's specific PPI category. Manufacturing businesses should watch materials costs. Service businesses should watch prices for supplies and equipment.

Consumer spending

Shows how much money consumers are spending and where they're spending it. This indicates whether people are tightening budgets or spending freely.

Where to find it: Bureau of Economic Analysis consumer spending data

What to look for: Spending trends in your industry category. Growing spending means opportunity. Declining spending means you need to compete harder for a shrinking pie.

Business loan interest rates

Nav publishes small business loan interest rates showing what businesses are currently paying for financing. This helps you evaluate if rates you're offered are competitive and plan for financing needs.

Where to find it: Nav average business loan interest rates.

What to look for: Rate ranges for different loan types (term loans, lines of credit, SBA loans) and how they're trending over time.

Small business sentiment indexes

Several organizations track how small business owners feel about current conditions and future prospects. These show whether other business owners are optimistic or concerned.

Where to find it:

- NFIB Small Business Optimism Index

- U.S. Chamber of Commerce Small Business Index

- Vistage CEO Confidence Index

What to look for: Whether sentiment is rising or falling, and what specific concerns business owners report.

How to interpret reports for business decisions

When you review these reports, look for trends and patterns and think about your best approach. Here are a few possible scenarios and potential actions:

If inflation is rising:

- Consider price increases before your costs force them

- Lock in supplier contracts at current rates if possible

- Build cash reserves faster

- Be cautious about taking on new debt at variable rates

If inflation is falling:

- Hold off on major price increases

- Consider whether costs might decrease

- Look for equipment or technology purchases that were too expensive before

If consumer spending is strong:

- Invest in marketing to capture demand

- Consider expanding capacity

- Launch new products or services

If consumer spending is weak:

- Focus on customer retention over acquisition

- Emphasize value in your messaging

- Look for ways to serve budget-conscious customers

Monitoring frequency

How closely do you need to look at these reports? Each business has specific needs, but here are some guidelines:

Check these indicators monthly:

- Your industry-specific CPI and PPI categories

- Small business interest rates if you're considering financing

Review quarterly:

- Overall economic trends

- Business sentiment indexes

- Consumer spending patterns

When a report shows major changes that could affect your business, dig deeper. Read the full report or analysis from economists. Understand what's driving the change and how long experts expect it to continue.

Set calendar reminders to check reports consistently. Most of these reports are released on predictable schedules.

The bottom line: inflation and small businesses

Many small businesses struggle with increased costs, supply chain issues, high interest rates, and other challenges. While some businesses will languish, others will emerge stronger.

Whether it's adapting technology to streamline operations, creating new product lines, raising prices strategically, or finding new revenue streams, there are businesses that will flourish. The difference comes down to how quickly you recognize changes and take action.

Whether it's this year or next, the Federal Reserve will likely lower interest rates, and when it does, consumer spending will likely increase. Continually working on creating a financially healthy business prepares you for what comes next.

Nav can help you manage your cash flow and credit in one dashboard. Understanding your business's financial health and credit standing can help give you the foundation to make smarter decisions and find financing when opportunities arise.

Track your business and personal credit for free

Get a clear view of your business and personal credit standings with a free Nav account. See your credit grades across major business bureaus to know where you stand today.

Build your foundation with Nav Prime

Options for new businesses are often limited. The first years focus on building your profile and progressing.

Get the Main Street Makers newsletter

Rate this article

This article has not yet been rated

Gerri Detweiler

Education Consultant, Nav

Gerri Detweiler has spent more than 30 years helping people make sense of credit and financing, with a special focus on helping small business owners. As an Education Consultant for Nav, she guides entrepreneurs in building strong business credit and understanding how it can open doors for growth.

Gerri has answered thousands of credit questions online, written or coauthored six books — including Finance Your Own Business: Get on the Financing Fast Track — and has been interviewed in thousands of media stories as a trusted credit expert. Through her widely syndicated articles, webinars for organizations like SCORE and Small Business Development Centers, as well as educational videos, she makes complex financial topics clear and practical, empowering business owners to take control of their credit and grow healthier companies.