Get your business credit reports

Nav Prime is the only place you can get detailed business credit report data from Experian, Equifax, and Dun & Bradstreet. Join Nav Prime now to see what lenders see and take next steps to build your business credit.

See what lenders see

Lenders use your business credit report to determine whether to offer your business loans and other financing options. Your report helps you understand what you need to work on to move forward — whether that’s adding tradelines to build more positive business credit history, improving personal credit, or managing debt more effectively.

Look out for fraud

You can’t freeze business credit reports if you suspect fraud. This means that you need to detect fraud as soon as it happens to avoid costly impacts to your business — especially your business credit.

Make monitoring your business credit part of your normal routine for overall financial hygiene. This can help you spot mistakes or unusual activity so you can dispute them more quickly and mitigate the potential negative effects on your business credit.

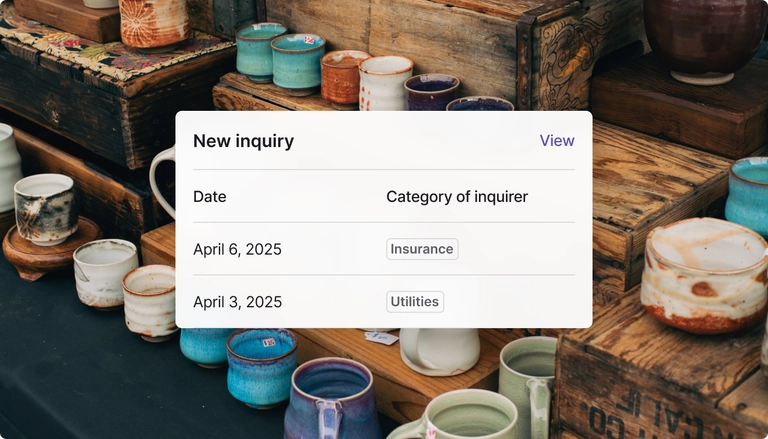

Track key changes

Nav gives you real-time business credit alerts so you can track the progress you’re making and adjust your priorities accordingly. Understanding what to focus on and what habits have made an impact can help you plan the right next steps for making further improvements.

Keep tabs on your business credit with all three major bureaus with Nav.

What is a business credit report?

A business credit report is like a report card for your business’s financial responsibility. Lenders may use it to assess whether to extend financing options to your business. Vendors use it to determine if your business can qualify for trade credit and on what terms (like net-30). Business partners use it to gut check the risk of working with you.

Business credit reports typically contain the following sections:

Business information

- Your business’s name and address: Basic information to ensure the accuracy of your report.

- Your business start date: Often used to calculate your time in business, a key factor in credit decisions. A longer time in business tends to be viewed more favorably.

- Estimated monthly revenue: Higher revenue is looked at more favorably, and could result in higher credit limits and funding amounts.

- Your business’s industry code (SIC or NAICS): Industry is a key factor in assessing a business’s risk. Certain businesses may be viewed as riskier to extend credit to by a lender or vendor.

- Legal entity: Helps legitimize your business in the eyes of lenders and business partners, and allows you to separate your business and personal finances.

Revenue can be difficult for credit bureaus to obtain or maintain, so don’t worry if it’s outdated. Your current business address and SIC or NAICS codes should be accurate. If not, contact the bureaus to correct them.

Account history

This is a key section of your credit report. You’ll find payment history for business loans, credit cards, and supplier accounts. You may also find whether the account was paid on time and recent balances (creditors may report before they receive your most recent payment).

Public filings

Public filings are any business records available to the public, including bankruptcies, liens, or collections. Negative records can severely impact a business’s credit score and ability to secure financing, so it’s crucial to try and resolve them quickly.

Experian business credit report

Your Experian business credit report is organized into four main sections:

- Your scores and how they changed

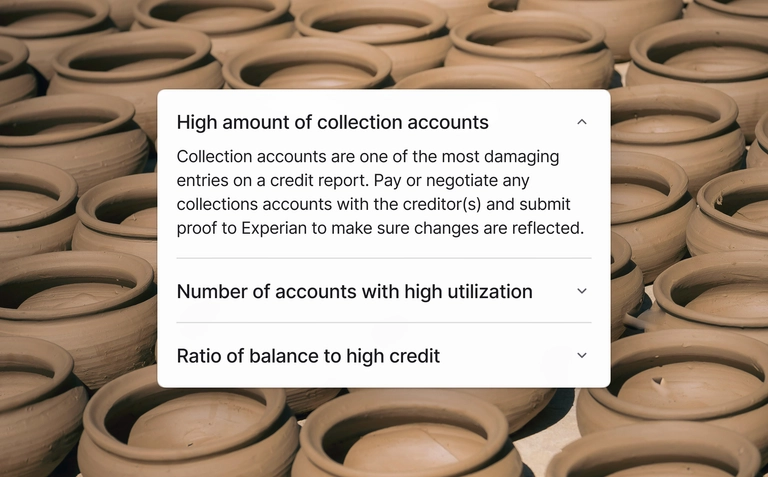

- What to focus on to improve your score

- Key factors that impacted your scores

- Business profile If you see any errors in your report, start by contacting the creditor directly.

If they can’t help, you can reach out to Experian. Their contact info is listed at the bottom of the report.

With your updated Experian business credit report, you have powerful insights and actionable steps that can help you build stronger business credit, all in one place.

Equifax business credit report sample

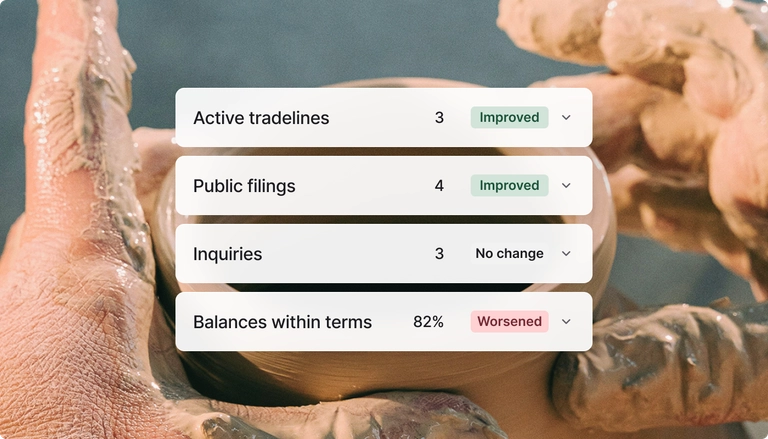

Your Equifax business credit report is organized into four main sections:

- Your scores and how they changed

- What to focus on to improve your score

- Key factors that impacted your scores (Keep in mind: Equifax doesn’t show account names for your active tradelines, only categories. So, you’ll need to do a little guesswork to see which vendors are reporting to Equifax).

- Business profile

If you see any mistakes on your report, be sure to contact the creditor directly — or reach out to Equifax. You can find their contact info at the end of the report.

Your Equifax business credit report helps you assess the financial health and creditworthiness of your business so you can work on improving your business credit.

Business credit report mistakes and disputes

According to the Wall Street Journal, about one quarter of business owners who checked their business credit reports found errors or missing information significant enough to lower their scores.

If you find mistakes on your business credit reports, you’ll need to dispute the incorrect information. Follow these instructions to dispute with each bureau:

How to establish business credit

In general, the key to building business credit is to do business with companies that report payment history — and then to pay on time and keep debt levels manageable.

If you have two or fewer credit references reporting on your business credit, you’ll want to build out your credit history with additional accounts. Here are three simple ways to get started:

- Get a business credit card: Most small business credit cards report to at least one of the major credit reporting agencies.

- Get vendor accounts: Purchase supplies for your business from companies that report trade credit (net-30, net-60, etc.). Here’s a list of easy net-30 vendors that report.

- Add existing accounts to your reports: You can ask companies with which you already have small business loans or accounts to report your payments, but that’s not always easy. With Nav Prime, you can add tradelines to help you build business credit.