Do Businesses Get a Free Annual Credit Report?

by Gerri Detweiler

You probably know that you are entitled to one free look at your personal credit report each year. There are a number of financial websites and services that exist to help people review their consumer credit reports, and even to get free credit scores. But, when it comes to getting a free annual business credit report, fewer options exist.

Why It’s Harder for Businesses to Get a Free Report

The Fair Credit Reporting Act is a federal law that stipulates how credit reporting agencies handle an individual’s credit file to safeguard privacy and financial accuracy. This includes the following rights:

- Free access to your consumer credit report once every 12 months

- The right to dispute inaccuracies on your report and receive a prompt response

- Notification from creditors and employers of adverse actions taken based on your report

Though this law revolutionized credit reporting for individuals, it does not apply to small business owners. Thus, business owners do not have the same rights when it comes to their business credit reports.

We are, however, starting to see a few credit bureaus and financial services companies offer business credit reports. In this article, we’ll cover the ways you can gain access to this information so you can ensure accuracy in your credit history and know where your business stands financially.

Why Your Business Credit Report is Important

Just like you (should) monitor your personal credit score and credit report so that you’re well-positioned to apply for a credit card, auto loan, or mortgage, you should also pay attention to your business credit history for similar reasons. Even if you don’t want to take out a business loan right now, there may come a day when you do, so building good credit now is essential.

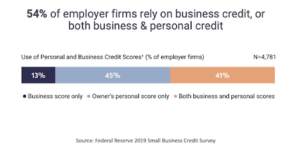

According to research by the Federal Reserve, over half of small business owners rely on business credit, or a combination of business and personal credit, when applying for financing.

Another reason to monitor your credit accounts and report is to circumvent identity theft. Yes, it can happen to your business. Imagine someone opens a business credit card in your company name and starts charging expenses like crazy and then doesn’t pay them off. It’s your business on the line. Monitoring your business credit report can help you spot things that shouldn’t be there, and you can get alerts when there’s suspicious activity that might be fraud.

Why You Should Care About Your Business Credit Score

So now you know why your business credit report is important, but what about your credit score? Well, that score will determine whether you qualify for any kind of small business financing, whether that’s a business loan, line of credit, or business credit card. So keeping track of yours and making sure it continues to rise is key.

There are actually several different business credit score models:

- Dun & Bradstreet PAYDEX

- Intelliscore Plus℠ from Experian

- FICO® LiquidCredit® Small Business Scoring Service℠

- Equifax Business Delinquency Risk Score

Those are just a few of the commercial credit scores available. Different lenders use different scores, but not all are available to business owners.

You may assume you have a great score, but if you’ve made a few late payments to your credit cards, it could dip. Even if you pay your bill late only once, your score can be negatively impacted. If you’re a victim of identity theft (without you being aware), your score could be affected. If you have tax liens, it influences your score. If you have several credit checks because you’ve been applying for loans all over town…yep. You guessed it. Your credit score will be impacted.

The best way to ensure you have a good credit score is to stay on top of what it is. Once you sign up with one of the services we’ll address in this article, check in on a regular basis and set up alerts to let you know if yours declines. Just keep in mind that dips are normal. If your scores change dramatically, though, you will want to dig deeper.

Request a Credit Report After a Loan Denial

If you have applied for a consumer loan or a credit card and have been denied, or have been denied for a request to increase your credit limit based on information in your credit report, you will be given the name of the company that supplied your credit report so you can request a free copy of the report. You’ll also get a disclosure of the credit score used in the decision.

These notices don’t apply to business credit, however. In fact, it’s entirely possible you won’t know why you were turned down for business financing. That’s why it’s so important to be proactive about reviewing your business credit.

Where to Get Your Free Business Credit Report Right Now

So now you understand a bit about why both your business credit report and credit score are so important to monitor. You’re ready to start managing your business credit, aren’t you?

As of right now, there are a few places where you can get your free annual business credit report. Some require more interaction with the company than others, and some provide more details on your credit history than others.

Credit.net

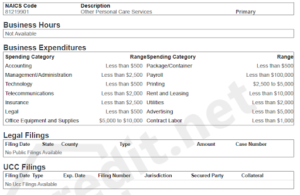

This site gives you access to a single report on your business, which can include details like:

- Bankruptcies, liens, and judgments

- Business details

- Credit rating score

- UCC lists

- Recommended credit limit

Pros: You can access your report with a free trial and no credit card is required. (Download your report if you want to refer to it again in the future.)

Cons: The data provided may be limited depending on your credit history.

Sample (excerpt):

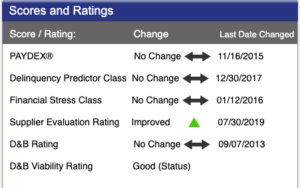

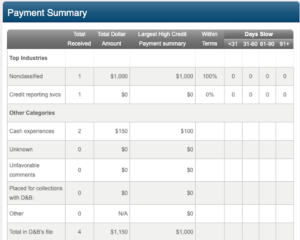

Dun & Bradstreet CreditSignal

This credit report contains information about your accounts, the highest balance, and whether you have paid on time. You also get notifications of changes to your business’ Dun & Bradstreet credit scores (including the D&B PAYDEX score), but not the actual scores.

Pros: Knowing whether your D&B scores change may be useful if you’re applying for financing with a lender who looks at it.

Cons: Dun & Bradstreet may contact you to try to get you to purchase additional products to help build your business credit.

Sample showing change in credit scores:

Sample showing payment history:

Creditsafe

Creditsafe offers similar features as the other credit report tools. It also allows you to track and monitor credit inquiries, which can be helpful, and it also provides trade payment analysis.

Pros: You can customize the types of alerts that matter to you most.

Cons: You may be required to speak with a Creditsafe representative to fully activate your report. Similar to Dun & Bradstreet, you may be encouraged to purchase additional products.

Sample: Note payment information is not available until you speak with a representative.

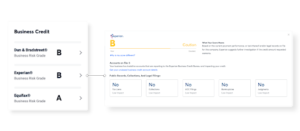

Nav

Nav is the only place that offers free access to a summary of both business and consumer credit reports. In addition to providing all of your credit scores for both business and personal, you’ll get matched with business credit card and loan offers that you have a high likelihood of being approved for.

Pros: Rather than having separate tools for business and personal credit reports, you have them both under one umbrella. You can get free reports from Dun & Bradstreet, Equifax, and Experian.

Cons: Free reports contain a summary of the report, not a full report. The score is displayed as a letter grade.

Each Business Credit Bureau

If you prefer checking your credit on your own, all three of the business credit bureaus will give you a full copy of your credit report for a fee.

Also note that your business credit score will likely differ between bureaus. They all use different models to compute your credit score and may have different information on file. Capital One, for example, reports small business credit card activity to Dun & Bradstreet and Experian but not to Equifax (business credit reports).

That’s why it’s important that you track each score and get a credit report from each bureau.

Check Your Credit Report and Credit Score Regularly

Staying on top of your credit score and regularly reviewing your credit report will ensure that nothing is amiss with your credit accounts, that you aren’t the unknowing victim of identity theft, and that you are well-positioned to qualify for financing, should you want it.

This article was originally written on September 28, 2015 and updated on December 9, 2021.

Rate This Article

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.